Finance and Legal Group

Taxes and Elections and Sunsets, Oh My! Tax planning for 2024 and beyond.Event Date:Presented by Andy Whitman, PhD, Licensed Attorney, Tax Preparer & Volunteer Financial Planner at Prepare + Prosper. Choose the moves that are right for you. Everyone's tax situation is different, consult with a tax professional to come up with a financial plan well before year end. More... |

Life & Estate Plans: Life, Incapacity, and GiftingEvent Date:Estate Planning Attorney Matt Guttman discusses trusts and other estate planning issues. More... |

Financial Life in RetirementEvent Date:Topics relevant to managing investments in retirement. By David Foster, CFP©, CRPC©, CRPS© More... |

Medicare Advantage (MA) and Traditional Medicare (TM): Issues & ChoicesEvent Date:We will continue to discuss the pros and cons of Medicare Advantage. You will also hear about notable non-health plan and non-broker resources. More... |

When will the Medicare advantage bubble burst? Part 2Event Date:This session will continue the discussion begun in the May 8, 2023 session. See that article for details. More... |

|

Commercializing UMN Research & Inventions- Yields Excellent, Lasting ReturnsEvent Date:UMN Technology Commercialization facilitates the transfer of UMN innovation beyond the research lab by helping our diverse researchers in development of new products and services that benefit the public good, foster economic growth, and generate revenue to support the University's mission. More... |

|

Tax update 2023 and 2024Event Date:Topics include tax changes; tax reducing moves required now and tax management in 2024. More... |

|

Estate PlanningEvent Date: Overview of all your important financial decisions from taxes to trusts and health care directives. More... |

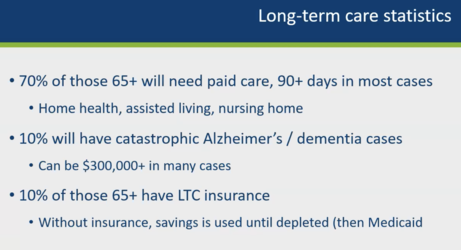

Long Term Care Insurance classEvent Date: Funding Long Term Nursing care as an ongoing issue. There are a number of factors that will determine if LTC insurance is right for you – your age, health, retirement goals, income and assets. More... |

|

Tax efficient distributions to family and charitiesEvent Date: This presentation was recorded at Carlson School. Topics included IRS compliant ways to make qualified charitable distributions (QCD) from your IRA or rollover IRA; funding gifts to Minors and other gifts; plus more. More... |

|

When Will the Medicare Advantage Bubble Burst?Event Date: Recording spreads awareness to rein in the Medicare Advantage (MA) privatized system, and protect traditional Medicare funding. More... |

Tax Update: Elections, Forgiveness, & Taxes, Oh My!Event Date:Todd J. Koch, CPA, MBT, CFP /JAK Partner, has again invited UMRA members to attend the year-end tax planning presentation for JAK clients. More... |

|

Estate PlanningEvent Date:Matt Guttman will give a webinar on Estate planning. A review of past webinars is good preparation for the fall 2022 programs. Review 2021 estate planning webinar. More... |

Tax Efficient Distributions to Family and CharitiesEvent Date:Todd J. Koch, CPA, MBT, CFP /JAK Partner, has again invited UMRA members to attend the year-end tax planning presentation for JAK clients. You may review the fall 2021 presentation recording and slides. |

Year End Tax PlanningEvent Date:Todd Koch, CPA, MBT, CFP, will review MN and Federal tax code changes, IRA and retirement account distribution strategies, and other important tax questions. More... |